AML Risk Scoring

Empower your KYC processes with ComplyCube's risk indicators.

About service

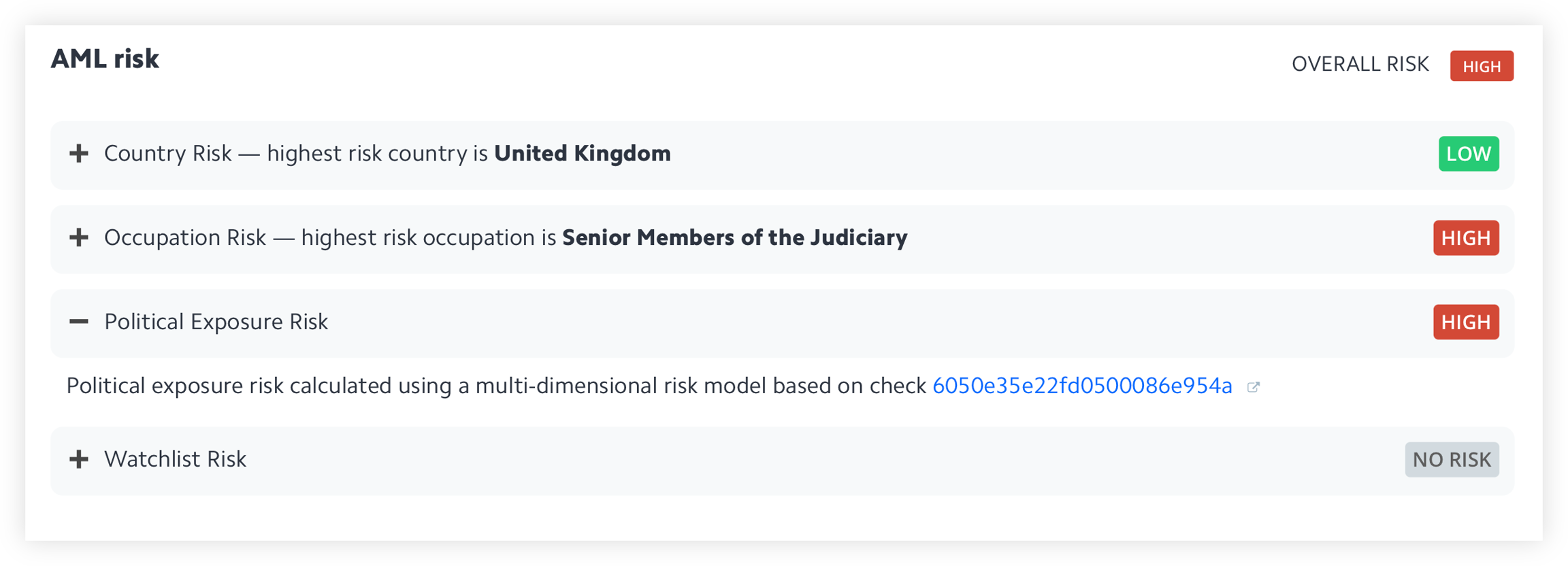

The AML Risk Profile provides a high-level snapshot of your customer’s key attributes and risk indicators.

It enables you to assess AML risk and apply the appropriate level of due diligence, whether Customer Due Diligence (CDD) or Enhanced Due Diligence (EDD).

Country risk scores are fully customizable within our Portal, allowing you to tailor them to your internal AML risk framework and organizational policies.

Interactive demo

Risk elements

The AML Risk Profile includes the following elements, each of which returns a result of High, Medium, or Low when applicable, or No Risk if not detected.

Overall Risk

A weighted score that combines all available risk elements to give a single AML risk indicator for the customer.

Political Exposure Risk

When a customer is confirmed as a Politically Exposed Person (PEP), this represents the calculated political exposure risk level.

Occupation Risk

When a customer is confirmed as a Politically Exposed Person (PEP), this represents the calculated occupation risk level. Certain occupations are considered higher risk due to their potential influence and exposure to corruption.

Watchlist Risk

When a customer is confirmed to be in a Sanctions or Watchlist, this represents the calculated watchlist risk level.

Country Risk

Evaluates the customer’s address, nationality, birth country, and incorporation country (for businesses).

ComplyCube calculates the score using data from industry-recognized bodies, including:

Corruption Perceptions Index

Federal Bureau of Investigation (FBI)

Financial Action Task Force (FATF)

FinCEN

Freedom House

Index of Economic Freedom

International IDEA Political Finance Database

Organisation for Economic Co-operation and Development

Transparency International

US Department of State

World Bank Group

World Economic Forum

This can also be customized to align with your own assessment criteria.

Triggers

The AML Risk Profile is automatically refreshed:

After check completion: Once a check is successfully completed and validated.

When customer details are updated: Any changes to client information will trigger a new profile calculation.